|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

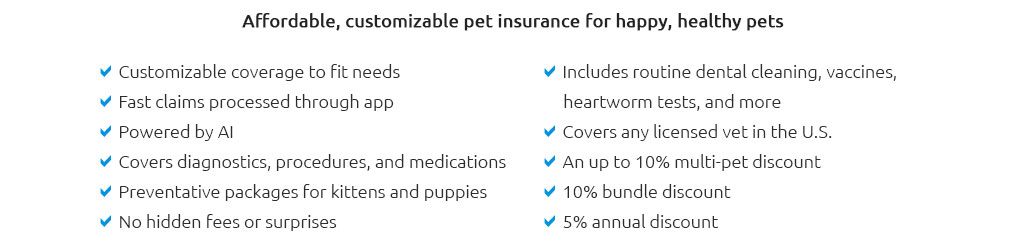

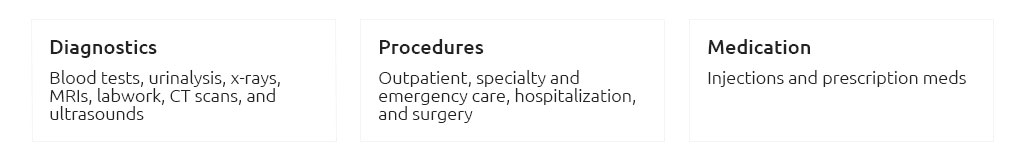

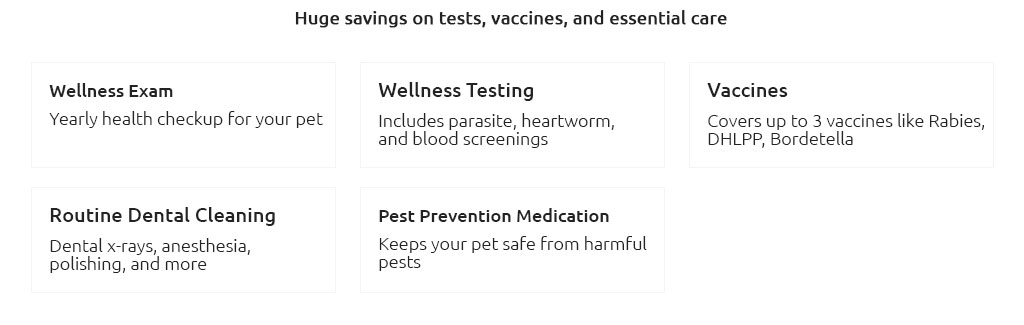

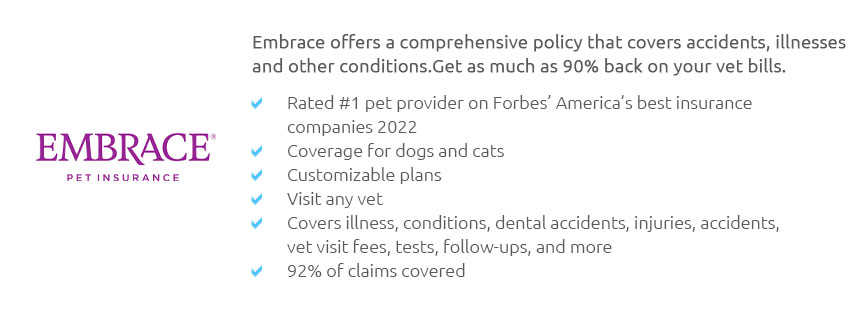

Exploring the Best Pet Insurance OptionsIn the contemporary world where pets are cherished as family members, safeguarding their health is paramount. The realm of pet insurance is vast and varied, offering a spectrum of options tailored to meet diverse needs. As a pet owner, the quest for the ideal insurance can be both bewildering and fascinating, given the plethora of choices available. From comprehensive plans covering a wide array of medical treatments to more economical options focusing on emergencies, the decision-making process demands careful consideration. What then, defines the best pet insurance? Let us delve into this intricate subject. Pet insurance primarily hinges on the breed, age, and overall health of your pet, influencing the cost and coverage scope. Companies like Healthy Paws and Embrace are often lauded for their extensive coverage options and customer service excellence. Healthy Paws, for instance, stands out with its unlimited lifetime benefits and the absence of claim limits, which is particularly advantageous for those with pets prone to chronic conditions. In contrast, Embrace garners attention for its flexibility and wellness rewards program, allowing pet parents to tailor coverage that aligns with their pet's specific health profile. Another commendable contender is Nationwide, renowned for offering one of the broadest coverage options in the market, including exotic pets, which is a rarity. Moreover, Figo emerges as a modern player with its tech-savvy features, such as a mobile app that streamlines claims processing and veterinary records management, appealing to the tech-enthusiast pet owner. While coverage is a crucial factor, the cost remains a pivotal aspect of decision-making. Typically, pet insurance plans range from $10 to $100 monthly, varying with the deductible, reimbursement level, and annual coverage limit chosen. It's prudent to compare different policies to discern which offers the best value for your financial situation and your pet's needs. A detailed analysis of the policy's fine print is essential to avoid unexpected exclusions or limitations, which could lead to out-of-pocket expenses during critical times. In conclusion, the best pet insurance is not a one-size-fits-all but rather a personalized choice that reflects your pet's unique needs and your financial capacity. By weighing factors such as coverage, cost, and customer service, and by seeking the advice of fellow pet owners and veterinarians, you can make an informed decision that ensures peace of mind for you and optimal care for your beloved companion. Frequently Asked Questions

https://www.nytimes.com/wirecutter/reviews/best-pet-insurance/

the best insurance plan is the one that offers you the best benefits and coverage for your pet at a reasonable priceand that can vary by pet ... https://money.com/best-pet-insurance/

Andrea has been our in-house pet insurance expert since 2021. She's dedicated hundreds of hours to researching and reviewing pet insurance companies and ... https://www.progressive.com/pet-insurance/

Pets Best offers two tiers of wellness plans that you can add on to your accident and illness pet insurance plan (known as the BestBenefit plan). Both of these ...

|